The End of Capitalism: The Productivity Paradox

It was in the ancient days of the early 70s that I saw and read this book. It was large, thin, and in thick cardboard pages. It was trying to tell us kids how much better the future would be and invoked a word: productivity. It claimed that productivity was growing rapidly, and that we would soon have twice the productivity of a generation before. What that meant was that we could do the same things in half the time, which meant that everybody would be able to work, say, only 20 hours a week and we’d get the same output. We could all be well-off and not work too hard for it.

That never panned out. Instead, the Average Joe today is working much harder for a lower standard of living than that of the kid in the early 70s. How is that possible, what went wrong, and what can we do about it?

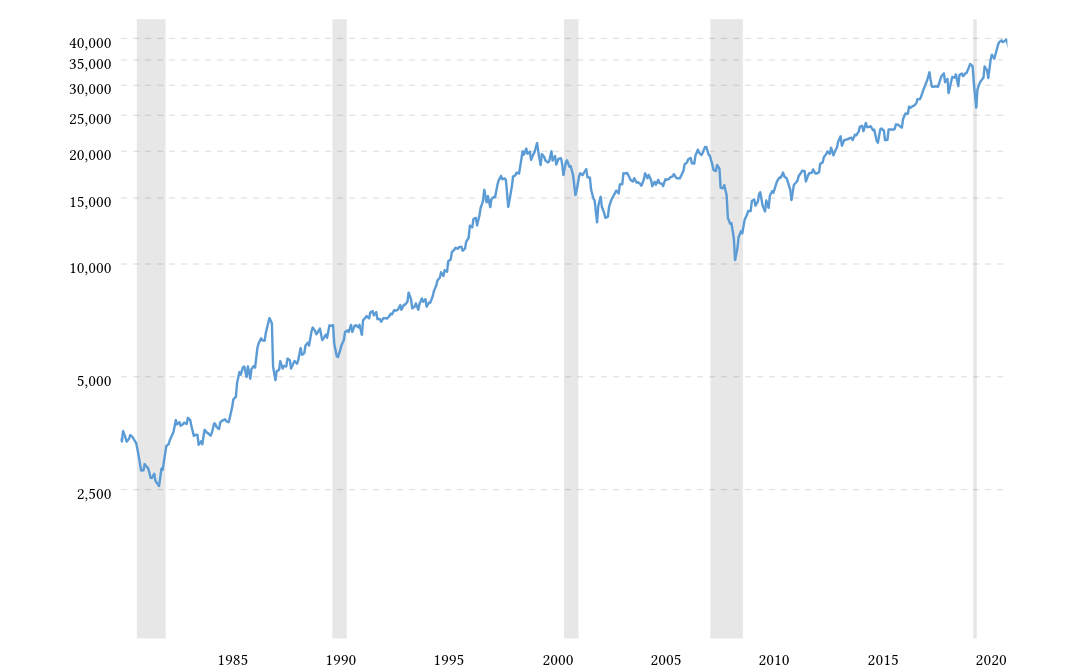

Productivity Increases

The core idea of the book was right: productivity, which is the amount of goods and services produced per unit of time worked, has consistently gone up over the past decades. In fact, the prediction that it would double from the 70s to the end of the millennium was more or less accurate:

The logic of the book was also correct: to keep production constant, only half the hours needed to be worked. We could live the same life as in 1970 by working half as much in 2000.

Now, notice that productivity is a macro variable. That means that it is the quotient of two other variables that are measured economy-wide, total domestic product and total hours worked. Productivity looks like it applies to the single worker, but it really only does to the economy. As an economist once quipped, if I eat two chickens for lunch and you starve, then each of us has on average had a chicken for lunch and should be satiated.

Where Did the Productivity Go?

A lot of the gains in productivity from the 1970s came from automation. In particular, factory jobs were replaced by robots. Another huge boost in productivity came from computers, that made everything more efficient, especially coordination. Finally, the improvements in communication made offshoring much easier.

Notice that the logic still holds: we could have started working shorter hours and produced the same (on average the economy would have grown because there are more people).

Instead notice that the productivity gains came from investments by corporations. Corporations bought robots and fired people. Corporations bought computers and threw out clerical employees. Corporations offshored manufacturing and production and fired more workers.

The result is that corporations netted all the gains from productivity increases. In essence, corporations replaced wages with capital investments and waited until the capital investment was offset by decreases in wage payments. That worked spectacularly well and sucked an enormous amount of money from wages to corporate profits.

What Does That Look Like For a Worker?

Going back to the example of the two chickens and your starving, when corporations made capital investments that allowed them to reduce wage “cost”, they reduced the need for hours worked. There weren’t fewer people because there were more robots and computers, which meant that demand for work decreased while the supply remained constant.

According to the Law of Supply and Demand, this resulted in an overall decrease of the value of work, which means wage stagnation/decrease. So, starting in the late 1970s, the indicators pointed towards salaries going down.

The public’s reaction was all wrong. Instead of recognizing that I was getting more and more chickens as you were more and more starving, the public started blaming the people for being lazy. In practical terms, that means that workers had to take on more work to make up for the loss in wages. There was an increase in double earners, in double jobs held by the same earners, and longer hours.

The perverse problem with this is that to keep one’s personal income constant, you’d have to work longer hours. The more hours each worker needs to work, the more total hours of work are available, pushing the value of work and hence wages down even further from an already depressed level.

What happened in the end was the exact opposite of the utopia my big cardboard book from the 1970s talked about: people worked ever harder for ever less money.

What Does That Look Like For a Corporation?

In the end, the macro-economic picture of productivity was still correct. Productivity went up, and since workers were getting less of the domestic product, someone else was getting more. In chicken terms, the number of roasted chickens was constantly growing, while the workers were downgraded from chicken, to breast, to skin, to bone. And also had to work twice as long for the same bone.

Who was getting all the chickens? Obviously, those who made the investments (corporations) and those that paid for them (investors). And, indeed, corporate profits started skyrocketing in synchronous motion with the returns on stock markets. In America, at least, some of the money from increased corporate profits went into lobbying for lower corporate taxes and dismantling social services, decreasing tax loads on profits and increasing the availability of cheap labor.

What is particularly interesting about the stock market performance is that, on its own, it would have trended down. As the Boomer generation started retiring, more money was taken out of the stock market than put in, which meant that demand for stocks should have gone down. That was the basic reason why the Bush administration proposed in 2005 to move Social Security to the stock market: it would have increased input capital into the stock market and hence stock prices.

That was not necessary, in the end, because while wages stagnated and inflation was low, domestic product continued to increase. The main difference with respect to the 1970s was that more and more of that increase went to capital-owning persons and institutions.

Could It Have Been Different?

The key mechanisms that led to the current situation were:

- Corporate investment into decreased labor/wage cost

- Reduced taxation of profits for high earners and corporations

- Unlimited supply of labor without real cost control

To reverse the changes and get to the utopia predicted in 1970, all three mechanisms need to be tackled separately.

Corporate Investment

Corporate investments are good. They are not only good on their own, as they can improve everyone’s life, but they are particularly good relatively speaking. Corporations that don’t invest usually fall behind their competitors and eventually disappear.

In this particular case, the issue is not the investment itself but the fact it targets specifically wage cost. That is not a necessary component in investment: for instance, modern semiconductor technology relies on automation because humans simply cannot assemble microprocessors at the scale robots can.

It is impractical to figure out the intentionality of investment. What is practical, though, is taxation based on outcome. In essence, if a corporation increases profits and (not necessarily because) lowers labor cost, then it gets taxed higher. That creates a natural incentive to avoid lowering labor cost by any of the mechanisms possible: wage decreases, employment decreases, worse conditions.

In a way, that is the opposite of the rhetoric used in the recent past: some politicians have called for a reduction in corporate profit taxation on the basis that it is a burden on job creation. The opposite is the case: lowering taxes on corporate profits creates an incentive to reduce expenses on tax deductible categories like salaries, wages, and general labor costs.

High-Income Taxation

The most obvious consequence of the funneling of productivity gains to the top is rising wealth inequality that results from income inequality. The most obvious solution is then to increase the taxation pressure at the top and reduce it at the bottom.

Taxation at the top must come from two separate sources, targeting both the problem areas, income and wealth. Income taxes need to be increased for high earners, in particular they need to be made more even - currently, income from wealth is treated more favorably than income from work.

At the same time, wealth taxes need to be instituted that add significant pressure on accumulated wealth. It should be generally impossible to live without work without seeing a reduction in one’s wealth.

Finally, transfers of wealth should be treated the same as transfers of income. In particular, that’s important for inheritance taxation, where the accumulation of wealth results in generational transfers to people with no relation to wealth building.

Labor Cost Control

The Federal Minimum Wage has not kept pace with inflation in decades. That is by design. The current income and wealth accumulation at the top is the direct result of the three mechanisms listed above, and it is no coincidence that corporate lobbying has targeted all three.

There are three mechanisms by which labor cost has been artificially kept down:

- Effectively reduced mandatory wages

- Reduced effectiveness of labor pooling / unions

- Dismantling of social service systems

Again, to remove labor cost control measures forced by corporate lobbying, all three must be addressed separately.

Minimum Wages

Sorry about the repeated pattern, but there are three sources of wage control:

- Minimum wages across the board

- Exceptions to minimum wage laws

- Limitations on hours worked

The first one is the most obvious one: wages should ensure simple outcomes. A person working a designated full time should be able to afford living at a certain standard of living. This doesn’t necessarily mean they should be able to own a home, two cars, and have a family with four kids, three dogs, and two cats. But the choice should start with the life we consider minimally acceptable for a wage earner, not with laws of supply and demand.

Notice how the rhetoric on the issue has focused on “good jobs” from the past versus “bad jobs” in the present. The “good jobs” brought high salaries for the average person, while the “bad jobs” are considered of inferior value because they pay less. Of course, there is nothing that makes a factory job that requires tightening a particular screw on an assembly line (see the movie, Modern Times) better than a fry cook job at a fast food restaurant. The nature of the job is not what made it “good,” it was simply the pay associated with it. And of course that pay has gone down in line with that of the fast food restaurant fry cook.

In addition to this, minimum wage laws should know no exceptions. Currently, we have several categories where minimum wages laws are not applicable, like hospitality and internships. This is done to facilitate additional income (as is the case for hospitality) or the entering of the labor force. But there are far better mechanisms for this than exceptions to minimum wage standards, and those should be pursued instead.

Finally, existing labor laws should be strengthened to apply to all workers (the exceptions for salaried workers, contractors, and executives should go). All employees should be paid by the hour, with predictable multipliers for overtime, off hours, holidays, etc.

Labor Pools

It is not a coincidence that unions were busted just as the societal transformation was in progress. It is a direct result of the desire to reduce labor costs coming from automation, and a direct result of trying to reduce the resulting friction.

The mechanism at work is simple: while corporations have become larger, using part of the newly gained profits to increase their own size by acquisitions, labor has become smaller. Since labor unions have become ineffective, the bargaining power of employees has steadily declined. Notice that this bargaining power has declined independently of labor union ineffectiveness, based on the issues of labor oversupply mentioned above.

The issue at hand is that, as corporations grow, their control of labor cost also grows. Imagine a corporation that controls the entire supply of jobs in a particular location, who then can control wages as they wish. Only pooling labor bargaining at a massive scale can prevent that.

Social Services

Taxation and labor laws only go so far to protect the lives of the impoverished. Lowering taxation of those that don’t make enough money to survive even without taxes is obviously not helpful, and trying to improve the work life of the unemployed will also not have an effect.

It is not a coincidence (a pattern you are seeing here) that social services were severely cut in the 1980s. By reducing the amount of support for the lower classes, a whole new proletariat was generated. This new underclass could not count on societal support and found out that it was near impossible to escape poverty once landing there.

From a corporate perspective, this served three goals:

- Reduction in social services allowed reduced taxation at the upper end

- The same also generated a desperate class willing to work at any wage

- The presence of a desperate class made the class just above too fearful of sliding down to resist those above

There is a very important remark that emerges from this: while the benefit for corporations was incremental, the downside for the individual was catastrophic.

It is perfectly unconscionable that a cost reduction of 5% for a corporation result in thousands of people in destitute poverty. The only reason we can accept this at a societal level is by ignoring the causal link between the two. And, in fact, we have gotten used to blaming the poor, even the homeless, for their own issues.

Instead, while the individual that ends up in poverty or homelessness may be responsible for their circumstances, the system itself (as shown above) makes those circumstances necessary. What changes is only the individual affected, not the existence of the problem. With the setup we have, a lot of people are going to be desperate, destitute, and homeless because that’s what the economics of the system demand.

The Root of the Imbalance

We have been taught that one of Henry Ford’s key innovations was to give his workers a living wage. By doing so (and indirectly pressuring competitors to do the same), he generated a relatively affluent middle-class of blue collar workers that could afford his product. In essence, a significant chunk of the wage increases went into buying a Ford.

The logic was solid. You cannot be successful as an entrepreneur if you don’t have customers, which includes people that simply cannot afford your product. Paying more than strictly necessary from a labor demand and supply perspective works as sort of a perverse marketing incentive.

But that logic isn’t working any longer. What changed is that corporations do not have to rely on their own workers for demand any longer. This is in part because automation has by itself reduced the number of workers, and because markets are now global.

Of the two, the second effect is dominant. Large corporations are shielded from the effects of local economies because they can extract value from economies far and wide. The sentence “Asia is a growth market for MANGA Inc.” is neutral in meaning, but the underlying idea is that the company is better off making Asian populations well-off enough to buy its products than Americans.

Why would it want to, though? The answer is simply that, to make the American population well-off enough to buy its products, it would have to pay higher taxes or pay more in labor cost.

How Do We Move On From This?

This article belongs to a series named, The End of Capitalism in which I try to discuss how Free Market Capitalism is simply not working any longer. While the series touches on internal issues of capitalism, mostly, this particular article is more about how capitalism has failed society.

For a very long time, the phrase a rising tide lifts all boats has been invoked to explain why increased corporate welfare would be good for everyone. But the mechanisms themselves of capitalist theory show that this is not the case: it is well possible, almost mandatory, for a society to worsen the lives of its constituents if it focuses on the well-being of its corporations and the wealthy.

What this article wants to show is that it is well within capitalist theory itself that this is possible, without invoking any other philosophy. Being a capitalist means accepting the possibility – almost inevitability – that consistent productivity gains will result in massively increased poverty. Which is the Productivity Paradox.

No inherent mechanism can reverse the Productivity Paradox. If unchecked, it will ensure that wages will continue to stagnate and decrease while people will be forced more and more into poverty and inhumane working conditions.

But there are battle-tested ways to deal with this. They mostly rely on popular uprising (pitting the many against the few – a very dangerous proposition) or on popular vote. Personally, I favor the democratic approach of voting for someone that equals the playing field. Generally, I can’t see how this can continue without change.